Exactly How a Home Mortgage Broker Can Assist You Browse the Complexities of Home Funding and Lending Application Procedures

Navigating the complex landscape of home funding can typically be a daunting job for possible buyers, particularly in a market loaded with diverse finance alternatives and differing lender demands. A home mortgage broker acts as an experienced intermediary, outfitted to improve the application procedure and customize their strategy to individual monetary scenarios. By leveraging their expertise, customers can not only conserve beneficial time yet also enhance their possibilities of protecting ideal financing terms. Recognizing the complete extent of just how a broker can aid in this trip elevates crucial inquiries concerning the subtleties of the process and the prospective pitfalls to avoid.

Recognizing Home Mortgage Brokers

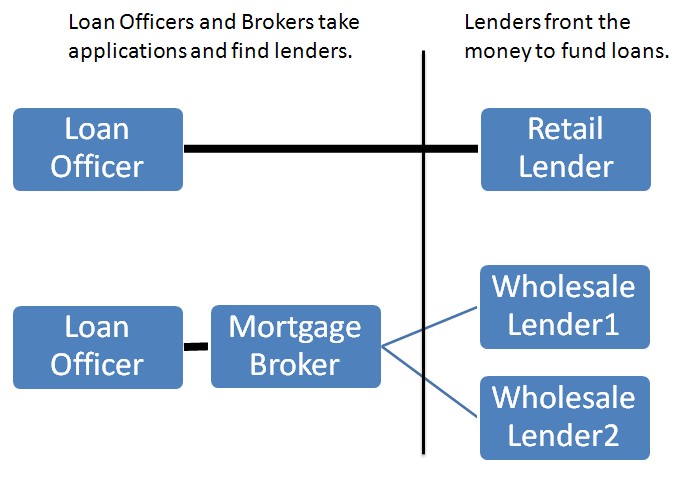

Home mortgage brokers have solid relationships with multiple loan providers, providing customers accessibility to a more comprehensive array of home mortgage items than they could find by themselves. This network enables brokers to work out much better prices and terms, inevitably profiting the consumer. In addition, brokers aid customers in collecting needed documents, finishing application, and making sure conformity with the loaning needs.

Benefits of Utilizing a Broker

Making use of a mortgage broker uses countless advantages that can substantially boost the home financing experience - Mortgage Broker Glendale CA. One of the main advantages is access to a wider series of financing products from several loan providers. Brokers have extensive networks that allow them to present choices customized to specific economic situations, potentially resulting in a lot more affordable prices and terms

In addition, mortgage brokers provide indispensable experience throughout the application procedure. Their knowledge of local market conditions and lending practices enables them to guide customers in making educated choices. This expertise can be particularly advantageous in navigating the documentation requirements, ensuring that all necessary paperwork is finished properly and sent in a timely manner.

One more advantage is the potential for time savings. Brokers take care of a lot of the research, such as gathering information and communicating with lending institutions, which allows clients to concentrate on various other facets of their home-buying trip. Furthermore, brokers typically have established relationships with lenders, which can promote smoother negotiations and quicker approvals.

Navigating Lending Options

Browsing the myriad of funding options offered can be frustrating for numerous buyers. With different sorts of home mortgages, such as fixed-rate, adjustable-rate, FHA, and VA finances, identifying the very best suitable for one's financial scenario requires cautious consideration. Each lending type has distinctive qualities, benefits, and potential downsides that can considerably affect long-term cost and financial stability.

A home mortgage broker plays an important duty in simplifying this process by giving tailored recommendations based upon individual scenarios. They have accessibility to a broad variety of lenders and can assist buyers contrast different finance items, ensuring they comprehend the terms, rate of interest, and repayment structures. This expert understanding can disclose options that may not be easily noticeable to the average consumer, such as specific niche programs for newbie customers or those with unique financial circumstances.

Additionally, brokers can aid in establishing the most suitable car loan amount and term, lining up with the purchaser's spending plan and future objectives. By leveraging their expertise, homebuyers can make informed decisions, prevent common pitfalls, and ultimately, safe financing that lines up with their needs, making the journey toward homeownership much less challenging.

The Application Refine

Understanding the application procedure is critical for prospective buyers aiming to safeguard a home loan. The home loan application process typically begins with celebration required paperwork, such as evidence of revenue, tax returns, and info on financial obligations and properties. A home mortgage broker plays a pivotal function in this phase, aiding customers compile and organize their monetary papers to offer a complete picture to loan providers.

When the documents is prepared, the broker submits the application to multiple loan providers in behalf of the consumer. This not just streamlines the process but also enables the customer to compare different financing alternatives effectively (Mortgage Broker Glendale CA). The lender will then conduct an extensive evaluation of the application, that includes a credit report check and an analysis of the debtor's monetary stability

Complying with the preliminary review, the lender may ask for added documents or information. This is where a home loan broker can offer indispensable support, guaranteeing that all requests are resolved without delay and precisely. Eventually, a well-prepared application enhances the likelihood of authorization and can cause much more beneficial lending navigate to this site terms. By browsing this complicated process, a home mortgage broker assists customers avoid possible risks and accomplish their home funding objectives efficiently.

Lasting Financial Advice

One of the vital advantages of functioning with a home loan broker is the stipulation of long-term monetary support customized to specific situations. Unlike typical loan providers, home mortgage brokers take a holistic technique to their clients' economic health, thinking about not just the immediate finance requirements however additionally future financial goals. This calculated preparation is vital for home owners who aim to preserve monetary security and construct equity over time.

Home loan brokers examine numerous factors such as earnings stability, credit rating, and market trends to suggest one of the most ideal loan products. They can also offer guidance on refinancing choices, prospective financial investment possibilities, and approaches for debt management. By establishing a long-term relationship, brokers can help clients navigate fluctuations in interest prices and realty markets, guaranteeing that they make educated decisions that straighten with their progressing my site financial needs.

Final Thought

In final thought, engaging a home loan broker can considerably ease the intricacies connected with home funding and the finance application procedure - Mortgage Broker Glendale CA. Inevitably, the assistance of a home loan broker not only simplifies the immediate process yet additionally gives beneficial lasting monetary assistance for customers.

Mortgage brokers possess solid partnerships with several loan providers, giving clients accessibility to More Help a wider variety of mortgage items than they could discover on their own.Furthermore, home mortgage brokers supply indispensable assistance throughout the finance application process, assisting customers understand the nuances of their financing choices. Generally, a home mortgage broker offers as an experienced ally, simplifying the home loan experience and enhancing the chance of protecting favorable loan terms for their customers.

Unlike conventional lending institutions, home loan brokers take a holistic strategy to their clients' economic health and wellness, considering not only the prompt finance requirements yet also future economic goals.In verdict, engaging a home mortgage broker can significantly relieve the complexities linked with home financing and the finance application process.