The Ins and Outs of Loans: Browsing Your Funding Choices With Confidence

Maneuvering the facility landscape of loans requires a clear understanding of numerous kinds and crucial terminology. Numerous individuals find themselves overwhelmed by alternatives such as personal, vehicle, and trainee loans, as well as essential ideas like passion prices and APR. An understanding of these principles not just help in evaluating financial needs but likewise enhances the loan application experience. However, there are significant variables and usual pitfalls that borrowers need to identify before proceeding better.

Understanding Various Kinds Of Loans

Loans function as important financial devices that deal with different requirements and objectives. People and services can choose from a number of types of loans, each made to fulfill details needs. Individual loans, commonly unsafe, provide consumers with funds for numerous personal expenditures, while vehicle loans allow the purchase of automobiles through secured funding.

Home loans, or home mortgages, help buyers in getting building, usually including lengthy settlement terms and particular rate of interest. Pupil loans, intended at moneying education and learning, often featured lower rates of interest and credit options until after graduation.

For businesses, industrial loans offer essential capital for growth, tools purchases, or functional costs. In addition, payday loans offer fast cash money services for immediate needs, albeit with higher rate of interest. Understanding the different types of loans enables borrowers to make enlightened decisions that align with their financial goals and scenarios.

Key Terms and Concepts You Ought To Know

Recognizing key terms and ideas is important when navigating loans. Rates of interest play a vital function in determining the cost of borrowing, while various loan types provide to different monetary needs. Familiarity with these components can empower individuals to make informed decisions.

Rate Of Interest Described

How do rates of interest effect borrowing decisions? Rate of interest represent the expense of borrowing money and are a crucial factor in financial decision-making. A higher rate of interest raises the total expense of a loan, making borrowing much less enticing, while reduced prices can incentivize consumers to take on financial debt. Lenders usage rate of interest to mitigate risk, reflecting consumers' creditworthiness and dominating financial problems - Installment Loans. Dealt with rates of interest remain consistent throughout the loan term, providing predictability, whereas variable rates can fluctuate, possibly causing higher settlements with time. Furthermore, recognizing the yearly portion rate (APR) is vital, as it includes not just interest but additionally any linked charges, offering a thorough sight of borrowing prices

Loan Enters Introduction

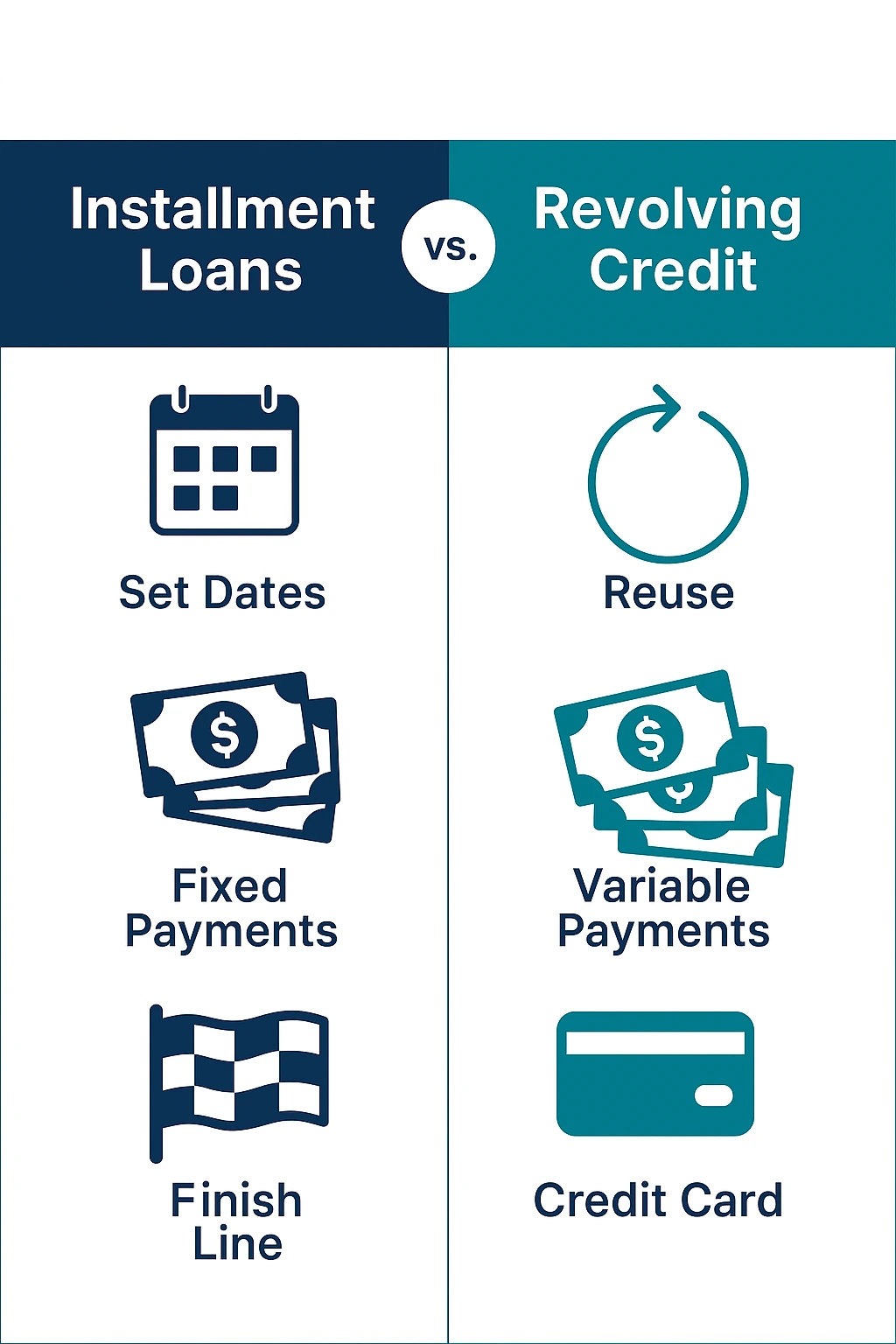

Maneuvering the landscape of loan kinds is vital for borrowers looking for the most suitable funding alternatives. Comprehending numerous loan kinds helps individuals make educated decisions. Personal loans are usually unsecured, optimal for settling debt or funding personal jobs. Mortgages, on the various other hand, are safeguarded loans particularly for acquiring property. Automobile loans offer a similar function, financing vehicle purchases with the car as security. Company loans satisfy business owners requiring capital for operations or development. Another choice, pupil loans, aid in covering instructional costs, typically with beneficial payment terms. Each loan kind presents distinct terms, interest rates, and eligibility criteria, making it essential for consumers to evaluate their economic needs and capabilities before devoting.

The Loan Application Refine Clarified

What actions must one take to successfully navigate the loan application procedure? Individuals should assess their monetary needs and determine the type of loan that straightens with those requirements. Next, they ought to evaluate their credit rating report to verify precision and determine locations for renovation, as this can influence loan terms.

Following this, debtors should gather needed paperwork, consisting of proof of income, work background, and economic statements. Once prepared, they can come close to loan providers to make inquiries concerning loan products and interest rates.

After choosing a lender, finishing the application accurately is vital, as errors or noninclusions can delay processing.

Lastly, candidates should await potential follow-up requests from the lender, such as added documentation or clarification. By following these actions, individuals can improve their possibilities of a smooth and reliable loan application experience.

Aspects That Impact Your Loan Authorization

When taking into consideration loan approval, a number of crucial variables enter into play. Two of one of the most significant are the credit report and the debt-to-income ratio, both of which provide loan providers with insight into the customer's economic security. Recognizing these elements can substantially improve a candidate's chances of securing the preferred financing.

Credit Score Value

A credit score offers as a vital standard in the loan authorization process, affecting loan providers' perceptions of a consumer's monetary reliability. Normally varying from 300 to 850, a greater score indicates a background of liable credit usage, including prompt payments and low debt utilization. Various factors add to this score, such as repayment background, size of credit history, kinds of credit report accounts, and current credit score inquiries. Lenders utilize these ratings to analyze threat, establishing loan terms, rates of interest, and the chance of default. A solid credit rating not just boosts authorization possibilities however can likewise bring about a lot more positive loan conditions. Conversely, a low score might lead to higher rates of interest or denial of the loan application entirely.

Debt-to-Income Proportion

Numerous lenders think about the debt-to-income (DTI) ratio an essential facet of the loan approval process. This financial statistics compares a person's regular monthly debt payments to their gross month-to-month earnings, providing understanding into their capability to manage added debt. A reduced DTI proportion suggests a healthier economic situation, making consumers extra appealing to lenders. Variables affecting the DTI ratio consist of real estate prices, charge card balances, pupil loans, and other repeating expenditures. Additionally, modifications in revenue, such as promotions or work loss, can substantially influence DTI. Lenders normally favor a DTI ratio listed below 43%, although this threshold can differ. Taking care of and understanding one's DTI can improve the opportunities of securing positive loan terms and rates of interest.

Tips for Managing Your Loan Responsibly

Common Mistakes to Avoid When Taking Out a Loan

In addition, numerous people hurry to approve the initial loan deal without comparing options. This can result in missed chances for far better terms or lower prices. Customers need to also avoid taking on loans for unneeded costs, as this can cause lasting debt problems. Finally, disregarding to assess their credit report can hinder their ability to protect beneficial loan terms. By being aware of these risks, customers can make informed choices and browse the loan procedure with greater confidence.

Frequently Asked Questions

How Can I Boost My Credit Score Prior To Looking For a Loan?

To enhance a credit score before making an application for a loan, one need to pay costs promptly, lower arrearages, check credit records for errors, and stay clear of opening brand-new credit accounts. Regular monetary routines yield favorable results.

What Should I Do if My Loan Application Is Denied?

Exist Any Kind Of Costs Linked With Loan Prepayment?

Car loan early repayment charges might use, relying on the lender and loan type. Some loans include fines for very early settlement, while others do not. It is crucial for customers to review their loan arrangement for certain terms.

Can I Work Out Loan Terms With My Lender?

Yes, customers can work out loan terms with their loan providers. Factors like credit score, settlement background, and market problems may influence the lending institution's readiness to modify rate of interest, settlement timetables, or charges related to the loan.

How Do Rates Of Interest Affect My Loan Repayments With Time?

Rates of interest considerably affect loan payments. Greater rates cause enhanced monthly repayments and total passion expenses, whereas reduced rates reduce these expenditures, eventually affecting the customer's overall monetary worry throughout the loan's duration.

Numerous individuals discover themselves bewildered by options such as personal, vehicle, and trainee loans, as well as essential ideas like interest prices and APR. Interest rates play a vital duty in identifying the price of borrowing, while different loan types provide to various economic demands. A higher rate of interest price raises the overall expense of a loan, making loaning here much less appealing, while lower prices can incentivize customers to take on financial debt. Fixed interest rates stay consistent throughout the loan term, supplying predictability, whereas variable rates can vary, potentially leading to higher settlements over time. Car loan early repayment costs might use, depending on the lender and loan type.